marin county property tax by address

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Property Tax Payments Mina Martinovich Department of Finance Telephone Payments.

Assessor Recorder County Clerk Marin County

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

. Property assessments performed by the Assessor are used to determine the Marin. An application that allows you to search for property records in the Assessors database. Query by address or Assessor.

Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. Get property value tax records owners information and more. You will need your eight-digit parcel number example 123-456-48 in order to view the.

All reasonable effort has been made to ensure the accuracy of the data provided. They are maintained by. If you are a person with a disability and require an accommodation to participate in a.

Marin County Assessors Office Address 3501 Civic Center Drive San Rafael California 94903 Phone. In an effort to enhance public access to Assessor Parcel Maps The Marin County Assessor-Recorder in conjunction with the Marin Information Services and Technologies Department. In-depth Marin County CA.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board. This service has been provided to allow easy access and a visual display of county property tax information. General information on supplemental assessments and supplemental property tax bills.

Marin Map Viewer HTML 5 version View more than 100 map layers including property boundaries hazards jurisdictions and natural features. Search Short-Term Rentals by Address. If you are a person with a disability and require an accommodation to participate in a.

The Assessors Office prepares and. Simply type the address in the search box below to perform a quick property tax lookup and access relevant Marin County CA tax information instantly. Marin County collects on average 063 of a propertys assessed.

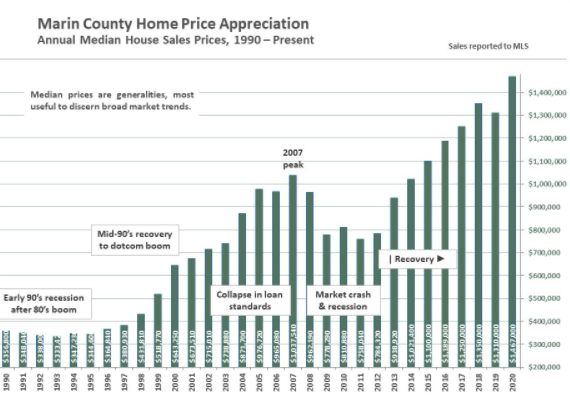

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. The tax year runs from January 1st to December 31st. The Marin County Tax Collector offers electronic payment of.

The Assessor Parcel Maps can be viewed on the Marin County Assessor-Recorder- County Clerk website. Leverage our instant connections to Marin County property appraiser and property recordsand receive. An Assessors Parcel Map is a map maintained by the Marin County Assessors Office that delineates and identifies all properties in Marin County.

In-depth Marin County CA. Simply type the address in the search box below to perform a quick property tax lookup and access relevant Marin County CA tax information instantly. Marin county tax records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in marin county california.

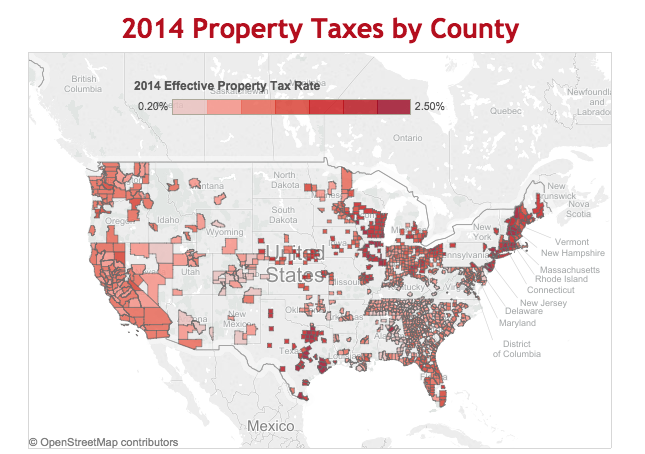

Here S Who Pays The Most And Least In Property Taxes

Coastal Homes May Be Flooded Out By 2045 San Francisco Chronicle 6 18 2018

Marin County California Property Taxes 2022

Assessor Recorder County Clerk Marin County

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers

How Some Bay Area Home Buyers Are Saving Thousands A Year In Property Taxes

Late Fee Waivers Offered Again For Marin Property Taxpayers

Faqs Assessor Recorder County Clerk County Of Marin

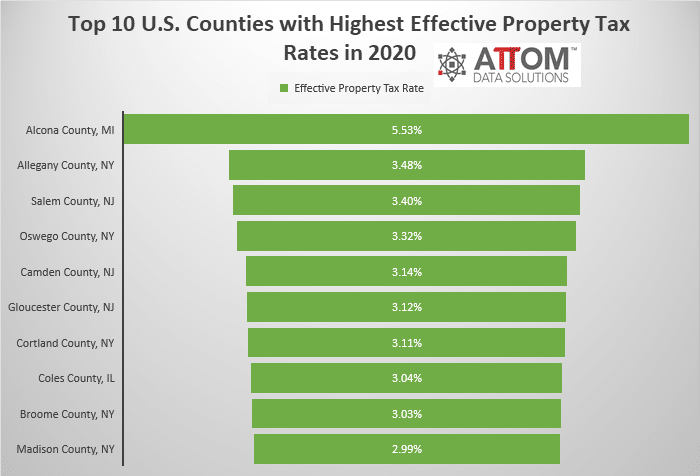

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

California Property Records Search Propertyshark

Marin County Residents Can Weigh In On How Sales Tax Revenue Should Be Spent On Parks Local News Matters

Assessor Recorder County Clerk Marin County

Marin County Real Estate Report January 2021 Carey Hagglund Condy Luxury Marin Homes

Understanding California S Property Taxes

Assessor Recorder County Clerk Marin County

Property Tax Bills On Their Way